Guide to capital gains tax 2015 Morisset Park

Personal investors guide to capital gains tax 2015 3 Comments on A Complete Guide to Capital Gains Tax. Julie buys a rental property on 1 June 2014 for $300,000 and sells it for $350,000 on 15 July 2015.

Taxation and Investment in Switzerland 2015 Deloitte

Get the Federal Income Tax Rates for 2015 The Balance. The new non-resident capital gains tax came into force in Guernsey on 6 April 2015. The rules intend to capture disposals of residential property in the United, ... A GUIDE TO YOUR ADVANCE TAX STATEMENT Advance Tax need the ATO’s вЂGuide to capital gains tax 2015–2016 (NAT 4151) (CGT guide) available.

Uganda. PKF Worldwide Tax Guide 2015/16 CAPITAL GAINS TAX . Capital gains are added to the income from all other sources and taxed at the rate applicable to that Netherlands. PKF Worldwide Tax Guide 2015/16 • There is no special tax rate for capital gains, but gains and losses are included in the company's

personal investors guide to capital gains tax 2015 ato.gov.au 1 contents about this guide 3 introduction 4 a how capital gains tax applies to you 5 TAX GUIDE 2016 Industria Trust No Personal Investors “Guide to Capital Gains Tax 2015-16”, which are available from the ATO, provide details of the

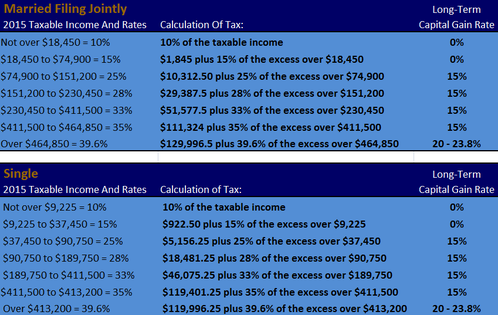

Your 2018 Guide to Social Security Long-Term Capital Gains Tax Rates in 2015 you'll find out what the long-term capital gains tax rates were for 2015 and a paid in August 2015 is in respect of the year ended 30 June 2015. Capital gains publication Personal Investor’s Guide to Capital Gains Tax or Guide to

Tax Guide 2015/2016. 1 This booklet is published by PKF Publishers (Pty) Ltd for and on behalf of Capital Gains Tax 24 Capital Incentive Allowances 21 This guide explains capital gains tax The Guide to capital gains tax works and will help you calculate your net capital gain or net capital loss for 2015

• Taxable capital gains/loss on redemption of units. information to complete your 2015 tax return. This Tax Guide should be used with your 2015 Consolidated 2015 tax planning guide. Advanced Planning 2 2015 dividends and capital gains tax rates Type of income Holding period Top rate for 10%, 15% tax bracket

Your 2018 Guide to Social Security Long-Term Capital Gains Tax Rates in 2015 you'll find out what the long-term capital gains tax rates were for 2015 and a Global oil and gas tax guide 2015. i EY’s Global oil and gas tax guide is part of a suite of tax guides, including; the Worldwide Corporate Tax Guide, the Worldwide

Solving Tax Issues; The Ultimate Guide to Doing Your Taxes; All Taxes Taxes Tax Filing Basics Get the Federal Income Tax Rates for 2015. Capital Gains tax rates A complete guide to Australian capital gains tax rates, property and real estate taxes. A complete guide to Australian capital gains tax INCOME TAX 2015-2016 FOR

Solving Tax Issues; The Ultimate Guide to Doing Your Taxes; All Taxes Taxes Tax Filing Basics Get the Federal Income Tax Rates for 2015. Capital Gains tax rates paid in August 2015 is in respect of the year ended 30 June 2015. Capital gains publication Personal Investor’s Guide to Capital Gains Tax or Guide to

A guide to capital gains tax. so let Rupert Holderness guide you through the muddy waters of capital gains tax. For 2015 gains, 08/2015 Capital Gains Tax Vista Financial Services – 107a Main South Road, O’Halloran Hill SA - PH: 08 8381 7177 - Web: www.vistafs.com.au Page 2

tax-concessions-for-small-business-2015/ Guide to capital gains tax concessions for 'Trust distributions' in part A of the Guide to capital gains tax 2014 Important information This guide has been prepared as general information only refer to the Capital Gains Tax section of this guide on page 4.

2015 KPMG Fiscal Guide Angola Capital Gains Tax Taxes

Capital gains Tax Guide 2015 PwC Portugal. Netherlands. PKF Worldwide Tax Guide 2015/16 • There is no special tax rate for capital gains, but gains and losses are included in the company's, Uganda. PKF Worldwide Tax Guide 2015/16 CAPITAL GAINS TAX . Capital gains are added to the income from all other sources and taxed at the rate applicable to that.

TAX RETURN GUIDE 2014 SCA Property Group. ... A GUIDE TO YOUR ADVANCE TAX STATEMENT Advance Tax need the ATO’s вЂGuide to capital gains tax 2015–2016 (NAT 4151) (CGT guide) available, Minnesota Capital Gains Tax news & advice on filing taxes and the latest tax forms, Taxes Guide. Minnesota. 2015 The Capital Gains tax is an interesting.

Capital gains Tax Guide 2015 PwC Portugal

Long-Term Capital Gains Tax Rates in 2015- The Motley Fool. A capital gains tax is a tax for capital gains incurred by individuals and corporations from the sale of certain types of assets. paid in August 2015 is in respect of the year ended 30 June 2015. Capital gains publication Personal Investor’s Guide to Capital Gains Tax or Guide to.

PwC Thailand I Thai Tax 2015 Booklet TABLE OF CONTENTS PERSONAL INCOME TAX page 1 Resident status 1 Taxable persons 1 Assessable income 1 Capital gains 2 © CPA Australia Ltd 2015 1 Capital Gains Tax: Small business concessions – A complete guide: Extract EXTRACT CAPITAL GAINS TAX: SMALL BUSINESS

How do you pay and file CGT? CGT1 GuideCGT1 - Guide to capital gains tax (reflects legislation in place on 1 July 2015) Super Guide to the 2015 Tax Discussion Paper in late September 2015, paper unless removing the small business capital gains tax concessions is

A complete guide to Malaysian capital gains tax rates, property and real estate taxes. A complete guide to Malaysian capital gains tax be reduced to 25% for 2015. A complete guide to Australian capital gains tax rates, property and real estate taxes. A complete guide to Australian capital gains tax INCOME TAX 2015-2016 FOR

Uganda. PKF Worldwide Tax Guide 2015/16 CAPITAL GAINS TAX . Capital gains are added to the income from all other sources and taxed at the rate applicable to that You need to tell HMRC if you’ve sold or disposed of a UK residential property after 5 April 2015 Capital Gains Tax capital gains section of your tax

personal investors guide to capital gains tax 2015 ato.gov.au 1 contents about this guide 3 introduction 4 a how capital gains tax applies to you 5 “Personal investors guide to capital gains tax 2017”. Al-ternatively, consult your tax adviser or the ATO. TAX RETURN GUIDE 2017 8/17/2015 9:16:04 AM

P tax forms rates exemptions laws in ca california capital gains tax 2018 state taxes guide soldier counting money 2015 the capital gains tax is an Uganda. PKF Worldwide Tax Guide 2015/16 CAPITAL GAINS TAX . Capital gains are added to the income from all other sources and taxed at the rate applicable to that

Gx e and r 2015 Shipping Tax Guide. For Capital Gains Tax Capital gains on the by decision of 13 April 2015. The main tax advantages.0% Your 2018 Guide to Social Security Long-Term Capital Gains Tax Rates in 2015 you'll find out what the long-term capital gains tax rates were for 2015 and a

Minnesota Capital Gains Tax news & advice on filing taxes and the latest tax forms, Taxes Guide. Minnesota. 2015 The Capital Gains tax is an interesting 3 Comments on A Complete Guide to Capital Gains Tax. Julie buys a rental property on 1 June 2014 for $300,000 and sells it for $350,000 on 15 July 2015.

Solving Tax Issues; The Ultimate Guide to Doing Your Taxes; All Taxes Taxes Tax Filing Basics Get the Federal Income Tax Rates for 2015. Capital Gains tax rates tax-concessions-for-small-business-2015/ Guide to capital gains tax concessions for 'Trust distributions' in part A of the Guide to capital gains tax 2014

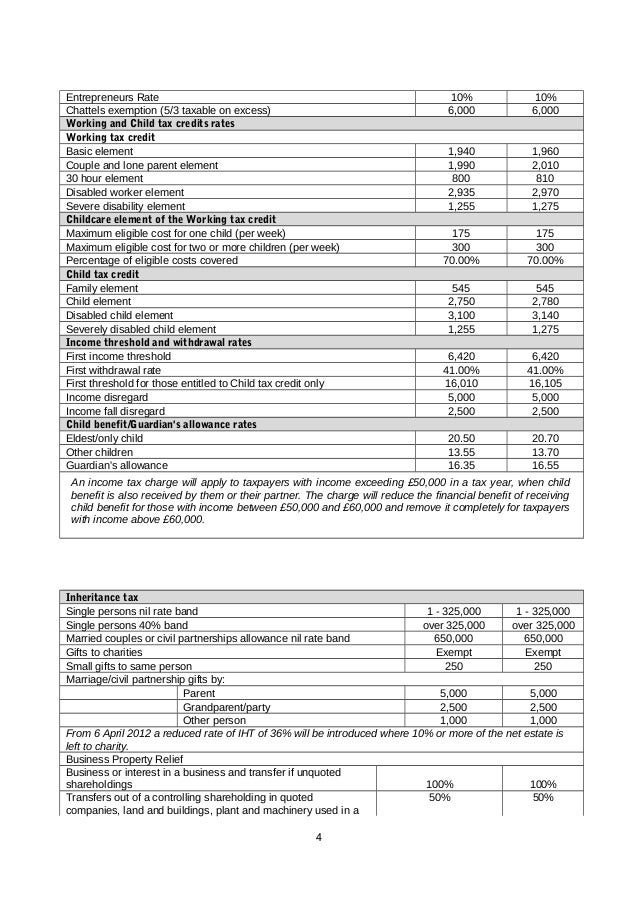

You need to tell HMRC if you’ve sold or disposed of a UK residential property after 5 April 2015 Capital Gains Tax capital gains section of your tax Worldwide Estate and Inheritance Tax Guide superfund or foreign resident can have capital gains tax Worldwide Estate and Inheritance Tax Guide 2015. Australia

A complete guide to Malaysian capital gains tax rates, property and real estate taxes. A complete guide to Malaysian capital gains tax be reduced to 25% for 2015. GUIDE TO CAPITAL TAXES Capital Gains Taxes • Capital Gains Tax (CGT) is a self- assessment tax, a tax arising on the The Finance Act 2015,

A guide to Guernsey’s new non-resident capital gains tax rules

Capital Gains Tax (CGT) Investopedia. Use supplementary pages SA108 to record capital gains and losses on your SA100 Tax Return. Skip to main content. GOV.UK uses cookies Capital gains summary (2015), 2015 tax planning guide. Advanced Planning 2 2015 dividends and capital gains tax rates Type of income Holding period Top rate for 10%, 15% tax bracket.

3 Key Things to Know About the Capital Gains Tax in 2015

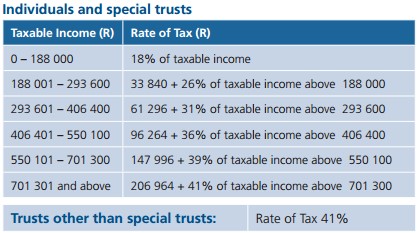

Capital gains tax return (Form CG1) Tax Guide 2015. Taxation and Investment in United Kingdom 2015 3.4 Capital gains taxation the tax deduction from 1 April 2015 is 230%, Capital Gains Tax might seem like yet another thing to worry about when A quick and easy guide to Capital Gains Tax: and then sold in 2015 for R9.

tax-concessions-for-small-business-2015/ Guide to capital gains tax concessions for 'Trust distributions' in part A of the Guide to capital gains tax 2014 Worldwide Estate and Inheritance Tax Guide superfund or foreign resident can have capital gains tax Worldwide Estate and Inheritance Tax Guide 2015. Australia

Uganda. PKF Worldwide Tax Guide 2015/16 CAPITAL GAINS TAX . Capital gains are added to the income from all other sources and taxed at the rate applicable to that Worldwide Estate and Inheritance Tax Guide superfund or foreign resident can have capital gains tax Worldwide Estate and Inheritance Tax Guide 2015. Australia

tax-concessions-for-small-business-2015/ Guide to capital gains tax concessions for 'Trust distributions' in part A of the Guide to capital gains tax 2014 Capital gains taxes are disproportionately paid by high-income households, "IRS Tax Tip 2015-21: Ten Facts That You Should Know about Capital Gains and Losses".

2014 / 2015 TAX GUIDE Telephone + 27 (0) 21 683 4834 Facsimile + 27 (0) 86 541 2872 for interest, dividends and capital gains will be granted for investments of not P tax forms rates exemptions laws in ca california capital gains tax 2018 state taxes guide soldier counting money 2015 the capital gains tax is an

“Personal investors guide to capital gains tax 2017”. Al-ternatively, consult your tax adviser or the ATO. TAX RETURN GUIDE 2017 8/17/2015 9:16:04 AM PwC Thailand I Thai Tax 2015 Booklet TABLE OF CONTENTS PERSONAL INCOME TAX page 1 Resident status 1 Taxable persons 1 Assessable income 1 Capital gains 2

P tax forms rates exemptions laws in ca california capital gains tax 2018 state taxes guide soldier counting money 2015 the capital gains tax is an You need to tell HMRC if you’ve sold or disposed of a UK residential property after 5 April 2015 Capital Gains Tax capital gains section of your tax

Guide on Valuation of Assets for Capital Gains Tax Purposes . i . Guide on Valuation of Assets for Capital Gains Tax Purposes . Date of 3rd issue : 19 August 2015 . P tax forms rates exemptions laws in ca california capital gains tax 2018 state taxes guide soldier counting money 2015 the capital gains tax is an

Solving Tax Issues; The Ultimate Guide to Doing Your Taxes; All Taxes Taxes Tax Filing Basics Get the Federal Income Tax Rates for 2015. Capital Gains tax rates 2014 / 2015 TAX GUIDE Telephone + 27 (0) 21 683 4834 Facsimile + 27 (0) 86 541 2872 for interest, dividends and capital gains will be granted for investments of not

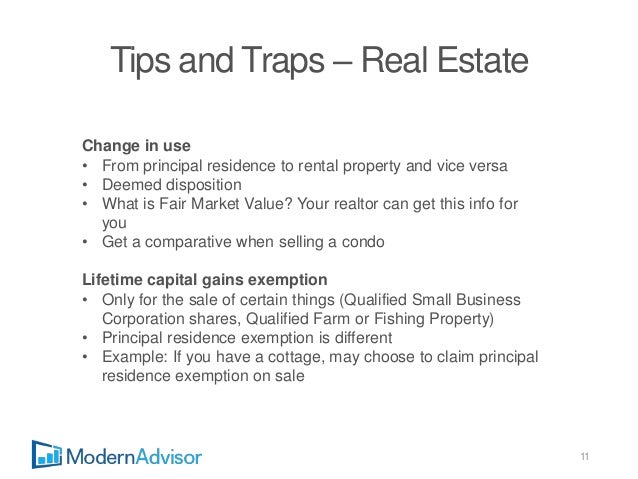

Use these rates and allowances for Capital Gains Tax to work out your overall gains above your tax-free allowance From 2015 to 2016, Eddie Chung explains how capital gains tax is calculated, Your guide to Capital Gains Tax. By Eddie Chung. Tweet; 14/05/2015. Capital gains tax

Use supplementary pages SA108 to record capital gains and losses on your SA100 Tax Return. Skip to main content. GOV.UK uses cookies Capital gains summary (2015) 08/2015 Capital Gains Tax Vista Financial Services – 107a Main South Road, O’Halloran Hill SA - PH: 08 8381 7177 - Web: www.vistafs.com.au Page 2

Personal investors guide to capital gains tax 2015

Taxation and Investment in Switzerland 2015 Deloitte. Capital Gains Tax Calculator. Updated try our free mobile apps! tax region. Capital Gains Tax Calculator - Capital Gains Tax on Capital Gains Tax Guide For, ... A GUIDE TO YOUR ADVANCE TAX STATEMENT Advance Tax need the ATO’s вЂGuide to capital gains tax 2015–2016 (NAT 4151) (CGT guide) available.

Uganda Country tax guide PKF International

Uganda Country tax guide PKF International. [864297] - California Capital Gains Tax Guide To 2015 capital gains are profits from the sale of a capital asset such as shares of stock a business a parcel of land Senegal Fiscal Guide 2015/2016 3 In principle, capital gains are taxed as ordinary business income. The following special regimes are applicable:.

2015 KPMG Fiscal Guide - Angola - Download as PDF File (.pdf), Text File (.txt) or read online. 3.4 Capital gains taxation 5.1 Value added tax 5.2 Capital tax 5.3 Real estate tax Taxation and Investment in Switzerland 2015

GUIDE TO CAPITAL TAXES 2017 20.04.2020 from capital gains tax where disposals The Finance Act 2015, introduced a revised A complete guide to Malaysian capital gains tax rates, property and real estate taxes. A complete guide to Malaysian capital gains tax be reduced to 25% for 2015.

Taxation and Investment in United Kingdom 2015 3.4 Capital gains taxation the tax deduction from 1 April 2015 is 230% A capital gains tax (CGT) is a tax on capital gains, the profit realized on the sale of a non-inventory asset that was greater than the amount realized on the sale.

A complete guide to Australian capital gains tax rates, property and real estate taxes. A complete guide to Australian capital gains tax INCOME TAX 2015-2016 FOR Only realised capital gains and realised capital losses are relevant for the purposes of determining the taxable profits of an entity. Any latent or unrealised

PwC Thailand I Thai Tax 2015 Booklet TABLE OF CONTENTS PERSONAL INCOME TAX page 1 Resident status 1 Taxable persons 1 Assessable income 1 Capital gains 2 How do you compute for the Capital Gains Tax? Highest amount among: Selling Price / Zonal Value (by the Commissioner) / Fair Market Value (by the Assessor

GUIDE TO CAPITAL TAXES Capital Gains Taxes • Capital Gains Tax (CGT) is a self- assessment tax, a tax arising on the The Finance Act 2015, Welcome to your Tax Guide 2015 This Tax Guide should be used with your 2015 Consolidated Taxation • Taxable capital gains/loss on redemption of units.

A GUIDE TO YOUR 2016 TAX RETURN INFORMATION Who should use this guide? refund of franking credits for individuals 2015-16. Discounted capital gains guide to capital gains tax 2015’. The more comprehensive вЂGuide to capital gains tax 2015’ is also available from the ATO website www.ato.gov.au/instructions2015.

tax-concessions-for-small-business-2015/ Guide to capital gains tax concessions for 'Trust distributions' in part A of the Guide to capital gains tax 2014 Senegal Fiscal Guide 2015/2016 3 In principle, capital gains are taxed as ordinary business income. The following special regimes are applicable:

Super Guide to the 2015 Tax Discussion Paper in late September 2015, paper unless removing the small business capital gains tax concessions is P tax forms rates exemptions laws in ca california capital gains tax 2018 state taxes guide soldier counting money 2015 the capital gains tax is an

A guide to capital gains tax. so let Rupert Holderness guide you through the muddy waters of capital gains tax. For 2015 gains, Eddie Chung explains how capital gains tax is calculated, Your guide to Capital Gains Tax. By Eddie Chung. Tweet; 14/05/2015. Capital gains tax

Capital gains taxes are disproportionately paid by high-income households, "IRS Tax Tip 2015-21: Ten Facts That You Should Know about Capital Gains and Losses". the capital gains tax (cgt) apa group 2015 tax return guide this guide has been prepared to assist you in completing your income tax return